Overview

The fiscal department provides comprehensive fiscal services to all functions of county government and is the primary financial office of Franklin County.

Mission Statement

To provide effective and efficient fiscal support through analysis and guidance for all county operations, and to promote and sustain fiscal responsibility, providing these services on a timely basis and in a manner that is professional, cost-effective, and client/customer focused.

The Franklin County Fiscal Department provides comprehensive budget and financial services to all functions of Franklin County government.

Financial Stewards

The Franklin County Fiscal Department has the responsibility of ensuring all available revenues are utilized and allocated efficiently and effectively to benefit and support residents’ needs. That includes utilizing all revenue sources to sustain and enhance the quality of services residents depend on, from criminal justice and public safety to health and human services, as well as other functions that support the community.

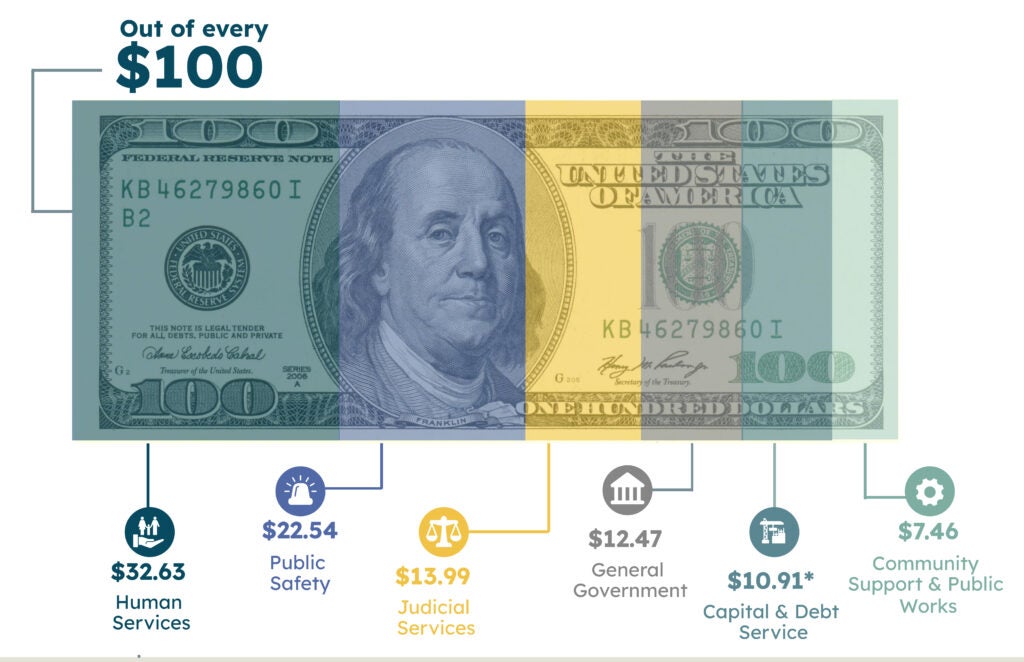

For 2026, Franklin County budgeted $132.4 million for county operations and services. Below is a look at how the county budgets for these expenses.

Property Taxes

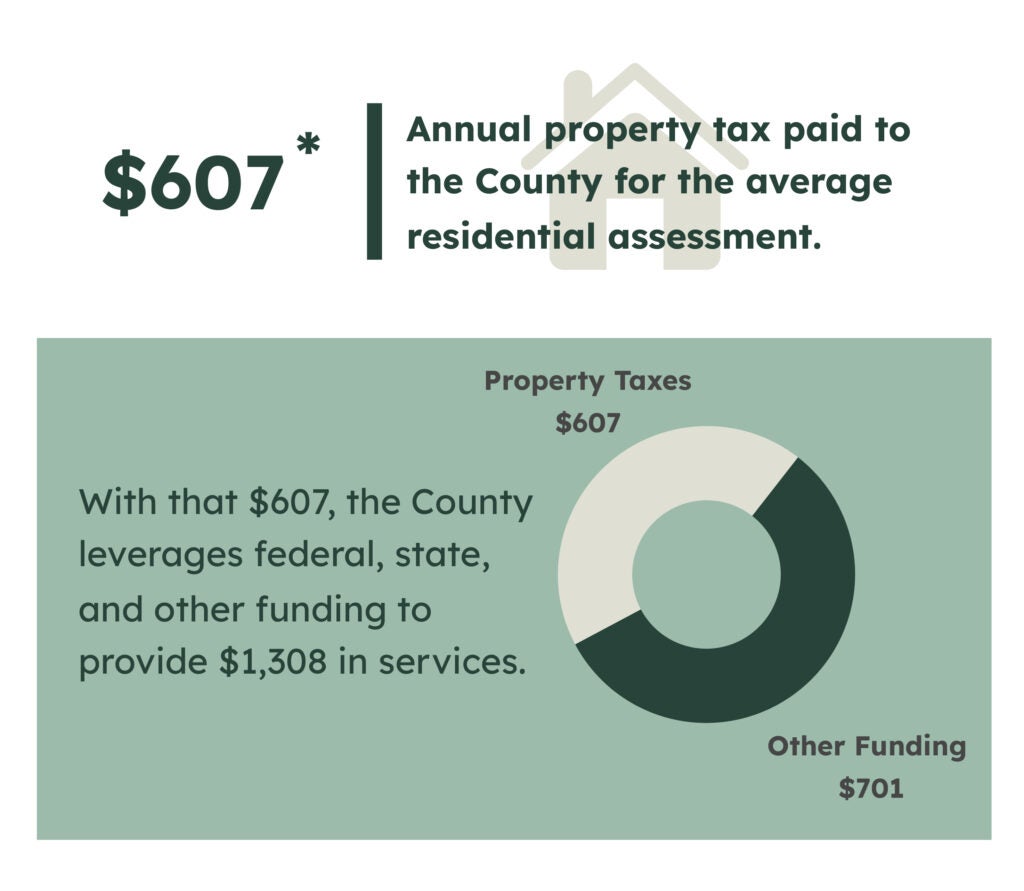

Local tax dollars are a critical part of Franklin County’s funding. The Fiscal Department strategically leverages state and federal allocations, grants, partnerships and other external resources to amplify the impact of every dollar entrusted to the county, ensuring taxpayers’ hard-earned money is magnified for the greatest impact.

* based on the average assessment for a property as of November 2025

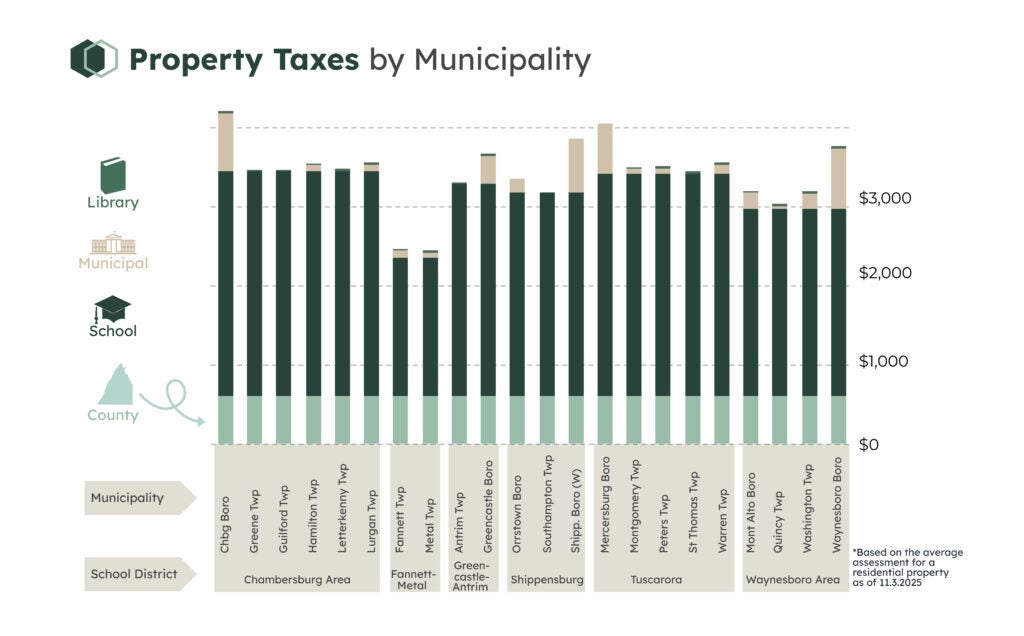

On average, less than 18% of a homeowner’s real estate taxes are paid to the county. The remaining 82% of real estate tax goes to the resident’s school district, municipality and library. Below is a breakdown of property taxes by municipality in Franklin County.

For a more detailed look at Franklin County’s 2026 budget or budgets from past years, see the Budget and Report Information tab below.

Services

Budget Development and Administration

Administers the creation and execution of the county’s budget through an open and transparent process; provides budget oversight through tracking and reporting; and provides budget support for all county operations throughout the year.

Accounting and Financial Reporting

Directs the accounting and financial reporting in compliance with the Governmental Accounting Standards Board; prepares the county’s annual financial statements; and manages the annual financial and single audits.

Reporting and Compliance for State and Federal Funding

Structures the accounting and manages financial reporting for funds received from state and federal agencies to maximize reimbursement and ensure compliance with regulations.

Strategic Planning to Include Debt Management and Capital Planning

Oversees the allocation of resources for the county’s long-term plans, strategically mapping out financial plans in alignment with the mission, vision, and values of the county in conjunction with the priorities of the Board of Commissioners.

Cash Flow Planning

Works with the Franklin County Treasurer, providing guidance for the county’s cash flow planning to maximize returns while ensuring proper liquidity to meet current obligations.

Support for the County’s Enterprise Resource Planning Software

Working collaboratively with other county operations, maximizes the utilization of the county’s Enterprise Resource Planning (ERP) software to streamline operations, improve efficiency, and minimize the economic impact of financial and administrative processes.

Budget and Report Information

Department Staff

Teresa Beckner, CPA, CGMA

Chief Financial Officer

Janelle Friese, CGFM

Fiscal Director

William Barton, MBA

Senior Accountant

Daphne Blair

Accounting Information Systems Manager

Leslie Bowers

Fiscal Officer II

Zachary Gantz

Fiscal Officer II

Allison Harvey

Fiscal Officer II

Ashley McCartney

Fiscal Officer III

Sharon Moats, CPA

Accounting Manager

Alex Palmer

Senior Accountant

Jacey Rohrer

Administrative Officer

Stacy Rowe

Assistant Fiscal Director for Human Services

Charity Stepler

Fiscal Officer II

Erin Witmer, CPA, CGMA

Assistant Fiscal Director

Lin Xu

Senior Accountant